In the last two years, the United States passed the most robust pieces of climate (industrial) legislation in its history, the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA). Someone with better political acumen should write about how the IRA was passed from a procedural/Politics perspective. It was quite the show.

Skipping all of the wonderful non-geologic storage pieces of the acts (which is most of it), I want to touch on the important pieces that directly and indirectly relate to Class VI wells and geologic storage. There was only a small sum of money, $75 million, given directly to the Class VI program, however, several other pieces of the legislation will necessarily affect it. Any carbon capture and storage (CCS) or direct air capture (DAC) facility that is planning to inject CO2 for dedicated storage will need a Class VI permit. The advancements to a piece of tax code known as 45Q, the CCS pilot/demo money, and the DAC hubs program will all incentivize more Class VI storage.

For a history of the Class VI program, check out the previous post here.

Infrastructure Investment and Jobs Act

The IIJA was unique in the world of federal legislation because it authorizes and provides appropriations for many programs. This means that congress will pay for those programs upfront rather than seeing if money is distributed to them in the appropriations process after the fact. This provides an important, clear market signal.

The language for each program below is taken from the Carbon Capture Coalition’s summary.

Carbon Capture, Utilization and Storage Research Development and Demonstration

Appropriates more than $3.47 billion over the course of four years for carbon capture demonstration and pilot projects that can scale-up the technology for commercial deployment. This money will flow through the newly established Office of Clean Energy Demonstrations at DOE.

CO2 Storage Commercialization Program

Authorizes $2.5 billion Large-Scale Carbon Storage Commercialization Program at DOE to provide grant funding for the development of new or expanded commercial large-scale carbon sequestration projects and associated carbon dioxide transport infrastructure, including funding for the feasibility, site characterization, permitting, and construction stages of project development. Language is derived from the SCALE Act.

Funding for Class VI well permits at EPA and States

Directs EPA to advanced Class VI injection well permitting for geologic CO2 sequestration, authorizing $5 million a year through 2026 for the EPA permitting process. Authorizes $50 million over five years for grants to states to defray the costs of state agencies for permitting and monitoring Class VI CO2 injection wells.

DAC hubs

Authorizes $3.5 billion for a program that will develop four regional, commercial scale direct air capture hubs that can remove carbon from ambient air resulting in negative emissions.

All told, there was over $12 billion of total investment into carbon management technologies and programs in the IIJA. Although the investment in the Class VI program is paltry, when compared in absolutes to the rest of the technologies, it will be the lynchpin of the entire legislation. Suppose we cannot federally permit Class VI wells, issue primacy, and assist states already with primacy. In that case, we cannot reduce, remove and store the amount of carbon needed to meet our climate goals.

Inflation Reduction Act

The IRA was light on the number of programs directly related to carbon management, let alone storage. Still, it contained enhancements to the industry's most significant piece of tax code: 45Q.

45Q is a provision of the United States tax code that provides tax credits for carbon capture, utilization, and storage (CCUS) projects. The provision was initially established in 2008 as part of the Energy Improvement and Extension Act and was subsequently expanded and enhanced in 2018 by the Bipartisan Budget Act. The tax credit was intended to incentivize the developing and deployment of carbon capture technologies, which could help reduce greenhouse gas emissions from industrial processes and power generation.

Initially, the tax credit provided $20 per ton of CO2 captured and stored permanently and $10 per ton of CO2 captured and used for enhanced oil recovery (EOR). However, the credit was not widely used due to various factors, including low carbon prices and a lack of infrastructure for carbon capture and storage.

In 2018, the 45Q tax credit was expanded and enhanced as part of the Bipartisan Budget Act. The credit was increased to $50 per ton of CO2 stored permanently and $35 per ton of CO2 used for EOR. The credit was also made available 12 years after the start of carbon capture operations rather than the previous 6-year limit. In addition, the credit was made available to a broader range of industries, including the petrochemical, cement, and steel industries.

Because 45Q is not capped (meaning there is no limit to the number of credits an entity can claim), it makes the United States government the de facto largest purchaser of CO2 in the world.

45Q

The IRA increased the credit amounts, how credit is distributed, and the threshold limits, all summarized by Clean Air Task Force.

The implications of these changes cannot be overstated. I could write a dedicated piece on why each change to 45Q is essential. The imperative is outside of a carbon pollution fee (sometimes, begrudgingly, called a carbon tax), there is no incentive for industry or power to capture their emissions. 45Q provides the financial incentive to capture and store emissions safely, deep underground. The graph below demonstrates precisely that, with the orange bar showing how the new 45Q places CCS in industry and power into or close to profitability.

Many variables go into retrofitting or a new build facility with CCS (location to inputs, price of natural gas or coal, location to geologic storage, need for transportation infrastructure, etc.), which is why the low-cost / high-cost designation is essential. Not all industrial or power facilities will or should be retrofitted with CCS. Other technologies like hydrogen or heat/power batteries can decarbonize the industry. Every project should be evaluated on its own merits, with CCS being one tool in an extensive toolkit.

DAC can gain even more from 45Q as there is no play for CO2 storage without it. Simply put, outside of voluntary purchases and state programs like the low carbon fuel standard, there is no dedicated revenue stream for geologic storage with DAC in the US. Now, companies can earn up to $180 / ton of removed CO2, helping to provide a dedicated revenue stream and de-risk the capital-intensive technology for traditional financing.

These enhancements have resulted in an influx of Class VI permit applications to the EPA. With the added funding for the UIC program and states applying for primacy, we should expect more Class VI permit to be issued. We should, anyway.

Investment relativism

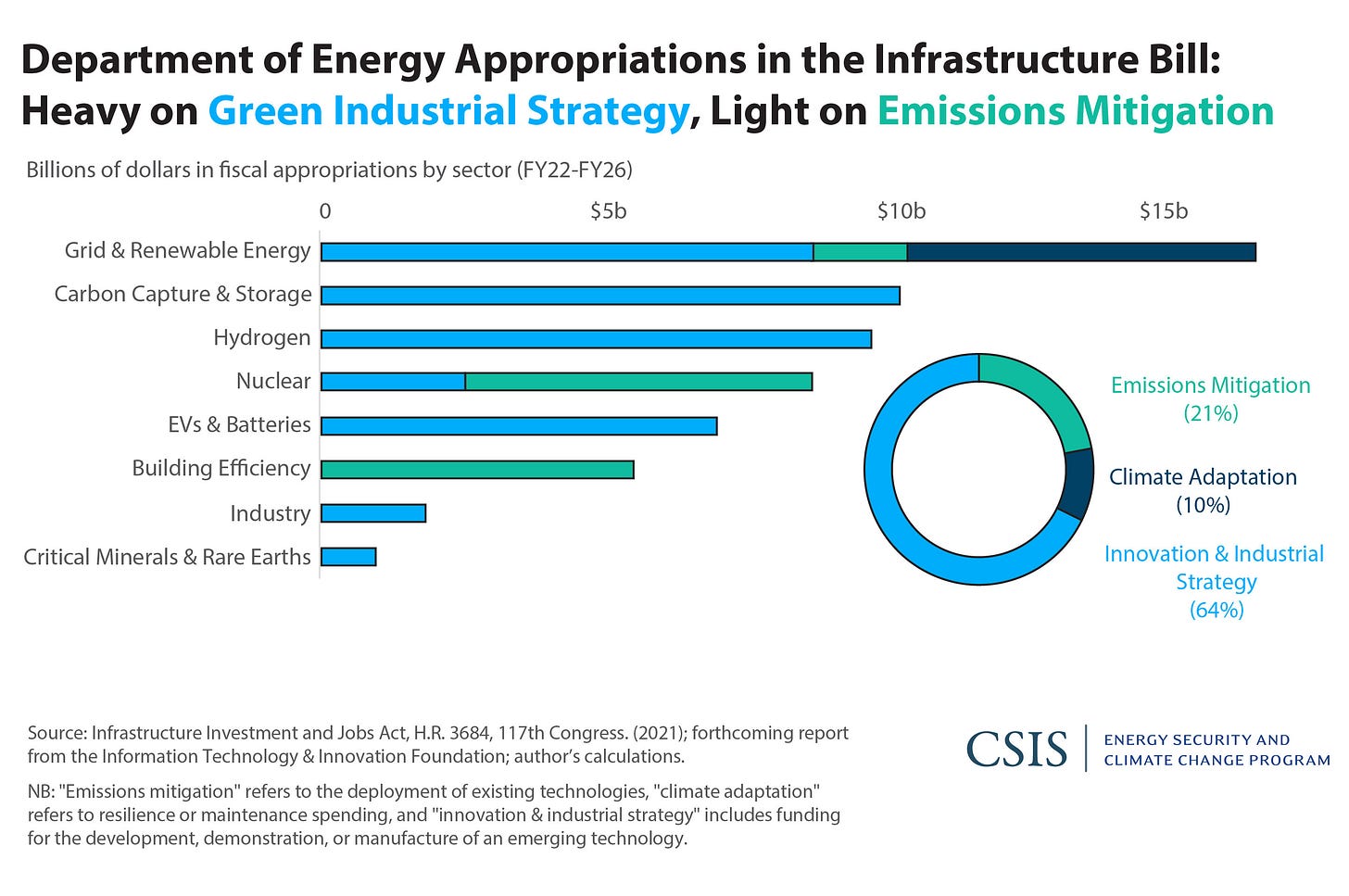

Between IRA and IIJA, substantial investments were made in carbon management. However, I think it’s important to view the IRA and IIJA investments in context.

This inclusion of this graph is not to play or pick favorites, as I think all viable climate options should be given the necessary amount of federal support to develop and deploy. I included this to show the cost of 45Q relative to other tax policies.

Next Generation Policy

These pieces of legislation were a historic investment in the clean energy future of America. They undoubtedly set us on the right path toward decarbonizing our economy and meeting our climate goals. But they are far from complete.

Regarding Class VI permitting, we still have several areas to cover. What should be done with states applying for primacy? How can we modify regulations to allow injection into non-sedimentary geologies like the beautiful basalts of the Pacific Northwest or the peridotites of California? How can states ensure property rights, pore space compensation, and long-term stewardship? What is a Class VII or Class VIII well?

In short, what does the next generation of CO2 storage policies look like? Next time.

This was great! I’m interested in the deltas for utilization v.s. storage for each source. I get why storage would be rewarded differently than utilization, but why would the deltas be different? And what effect will that have, if any?